Tag: Cushman

Vietnam ranks among most cost-competitive locations on global industrial map

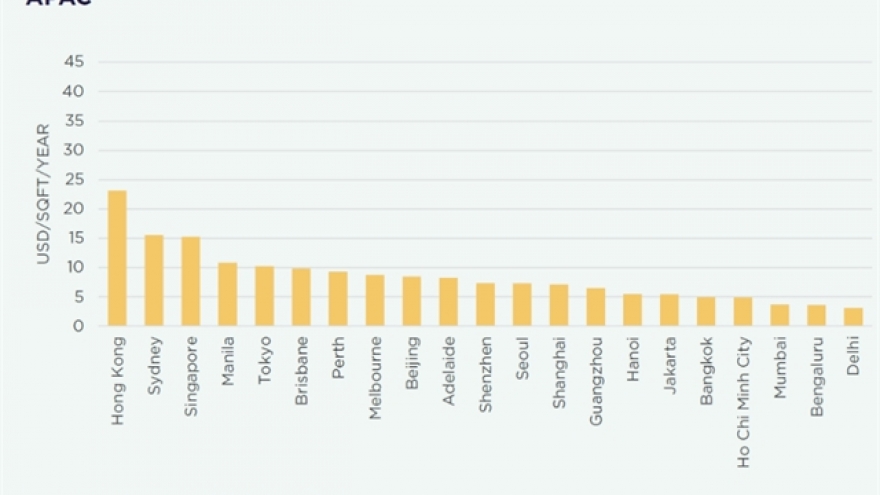

Vietnam has again been recognised as a highly cost-competitive location for industrial and logistics investment, ranking in the most affordable tier globally for rent, labour and energy.

Vietnam sustains high-quality FDI attraction amid global headwinds

VOV.VN - Vietnam is increasingly seen as a bright spot on FDI attraction amid global economic uncertainties, thanks to its strong post-pandemic recovery and dynamic industrial real estate market, said Trang Bui, head of Cushman & Wakefield Vietnam.

HCM City’s real estate market shows signs of recovery

Real estate revenue in Ho Chi Minh City reached VND173 trillion (over US$7 billion) in the first eight months of the year, up 6.1% year-on-year, according to the HCM City Statistics Office.

HCMC, Hanoi listed as emergers in Cushman Wakefield’s Inclusive Cities Barometer

Ho Chi Minh City and Hanoi have been listed as emergers in the Asia-Pacific region in the first Inclusive Cities Barometer recently released by Cushman & Wakefield, a leading global real estate services firm.

Vietnam to welcome large amount of new office supply: Cushman & Wakefield

Vietnam will welcome a large amount of new office supply in 2024, concentrating on the two main markets of Hanoi and Ho Chi Minh City, according to analysts from Cushman & Wakefield.

Vietnam has room to develop high-value manufacturing: Cushman & Wakefield

Vietnam’s high-value manufacturing is expected to grow, with the government intent on increasing manufacturing’s share of the economy from 25% to 30% by 2030 by attracting more high-value manufacturing investment, said the “Strength through Diversification: Opportunities across Asia Pacific” report by Cushman & Wakefield.

Foreign investments in property market expected to soar: experts

Foreign investors are expected to plough large amounts of money into the Vietnamese property market in 2024-26.

Southern industrial real estate sees high demand in Q3

The industrial real estate market in the south was vibrant and thriving in the third quarter of 2023, with the rental area reaching 143,000 sq.m, up 2.4 times compared to the previous quarter.

Condotel market forecast to continue falling until 2025

The Vietnamese condotel market will not recover at least until 2025 due to excess inventory, according to insiders.

Real estate market attracts foreign capital via M&As

A wave of foreign businesses are coming to learn about potential real estate projects in Vietnam to carry out mergers and acquisitions (M&As), reported Dau tu (Vietnam Investment Review) newspaper.