Vietnam emerges as preferred destination for Dubai investors

VOV.VN - Vietnam has emerged as a magnet for financiers from Dubai, especially in the spheres of real estate, tourism, and digital infrastructure, according to industry insiders.

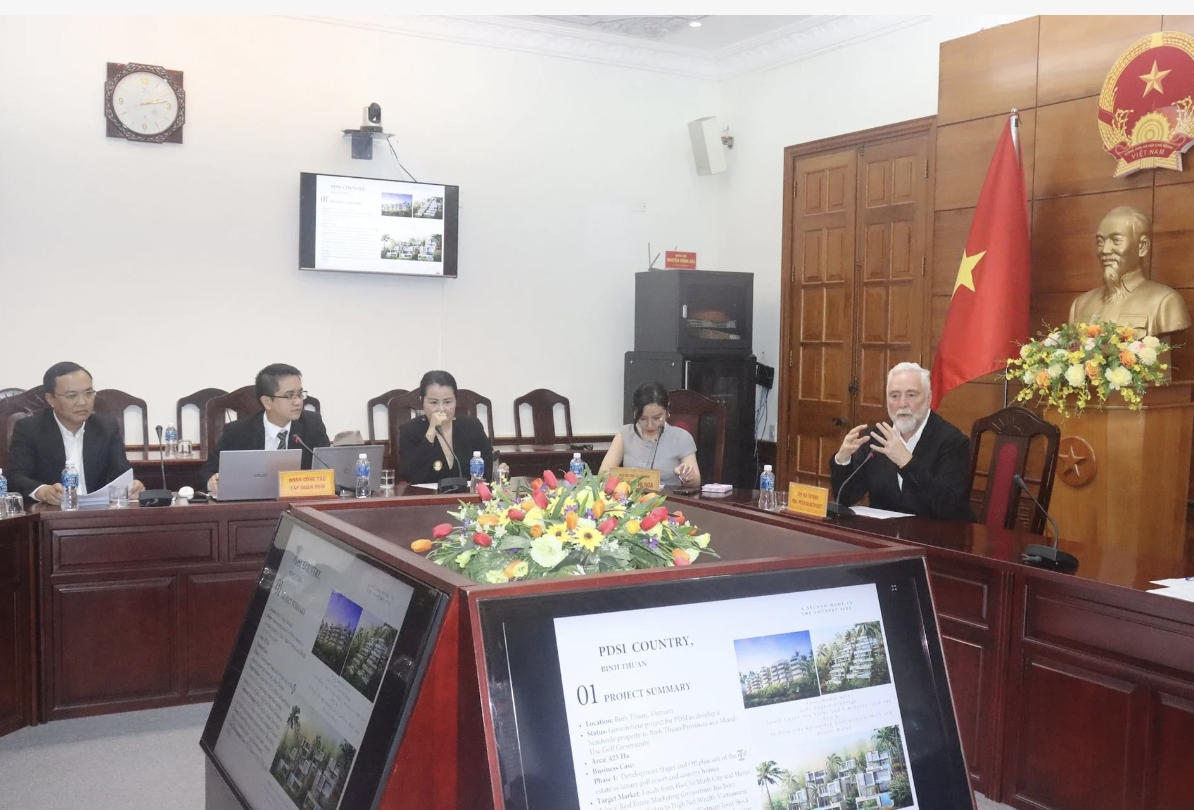

Recently, the Dubai-based multi-industry group PDSI proposed investing US$2.6 billion in a service complex combined with a golf course in Phan Thiet city, Binh Thuan province.

Peter Dalkeith Scott, president and CEO of PDSI Group, revealed that the project is expected to include apartments, resort hotels, residential areas, a commercial centre, parks, two golf courses, an international school, a private hospital, a community sports club, an indoor ski resort, and a wave pool.

This is a major investment opportunity and reflects the group’s long-term commitment to Vietnam, Scott told Investment newspaper. He recalled that PDSI has had a presence in Vietnam since 1992, when it partnered with Swiss and Singaporean firms to develop the Song Be Golf Course - the first international-standard golf course in Vietnam.

In 2017, PDSI established a joint stock company in Vietnam with both local and foreign partners to research the market and seek out meaningful investment opportunities. The group affirmed that it does not follow trends or short-term profits, but instead focuses on meeting the real market demand.

PDSI is not the only major Dubai player looking to invest in Vietnam. Damac, through its subsidiary Edgnex Data Centres, is planning to invest US$3 billion in data centre developments in Malaysia, Indonesia, and Thailand over the next five years. According to Bloomberg, Damac has already acquired land for four data centres in Malaysia and Indonesia, and is evaluating similar opportunities in Vietnam and the Philippines, with further details expected in 2025.

The expansion plan in Southeast Asia is part of Damac's global strategy worth US$5 - 7 billion to turn the region into a key digital hub for artificial intelligence (AI) and cloud computing services.

Meanwhile, Tyler McElhaney, country head at APEX, outlined that Vietnam is fast becoming a more attractive destination than ever for Dubai investors, especially after Vietnam and the United Arab Emirates (UAE) completed the Comprehensive Economic Partnership Agreement (CEPA) in October 2024.

With Vietnamese economic growth forecast to reach at least 6.5% in both 2025 and 2026, as well as a strategic focus on infrastructure development, Vietnam is unlocking countless attractive opportunities for UAE businesses, he noted.

He added that PDSI’s presence will play a significant role in elevating Vietnam’s tourism and real estate sectors - not only attracting high-end travelers and international investors, but also contributing to local infrastructure development.

With deep expertise in commercial development, investment, and consulting across Southeast Asia, Europe, Africa, Australia, and the Middle East, PDSI has the capability to make meaningful contributions to the Vietnamese market, he said.

High urbanisation rates, stable economic growth, and a series of large-scale infrastructure projects can be viewed as key factors which have helped Vietnam to attract investment capital, he stressed.

High-end projects such as golf resorts, luxury hotels, and multi-purpose complexes are all attracting interest and align with the strengths of Dubai investors, who are known for their ability to develop large-scale luxury real estate.

He recommended that financiers from Dubai choose the right local partners and orient their projects in line with the development goals of the Vietnamese Government, including smart cities, green energy, and sustainable infrastructure to reap success in the Southeast Asian nation.

In particular, he underlined the need to focus on investing in transport infrastructure and industrial parks – important pillars for Vietnamese economic growth and in attracting more foreign direct investment in the coming time.